Hardship Assistance Loans Now Available

Hardship Assistance Loans Now Available

Many Florida communities and families were impacted by Hurricane Ian that swept through Florida this week. As a community bank, MidWestOne is offering special assistance to help those communities as they recover.

Due to the magnitude of this storm, MidWestOne Bank is offering a Hardship Assistance Loan to residents in the counties that are part of the disaster declaration enacted by the President beginning Sept. 23 and continuing: Brevard, Broward, Charlotte, Collier, Desoto, Glades, Hardee, Hendry, Highlands, Hillsborough, Indian River, Lee, Manatee, Martin, Miami-Dade, Monroe, Okeechobee, Osceola, Palm Beach, Pasco, Pinellas, Polk, Sarasota, and St. Lucie counties, and the Miccosukee Tribe of Indians of Florida and the Seminole Tribe of Florida. The funds may be used for payment towards a deductible, uninsured cost of repairs, living expenses, and more. Many situations will be unique, and the bank will strive to meet most needs*.

Hardship Assistance Loan – Hurricane Ian

- Unsecured loan amounts from $1,000 to $7,500

- Fixed rate loan at current prime rate of 6.25% Annual Percentage Rate with an automatic payment from a MidWestOne deposit account; without automatic payment from a MidWestOne deposit account the Annual Percentage Rate will increase to 7.25%.

- Documentation Fee is waived; all other loan fees applicable

- Loans are subject to credit approval and underwriting standards

- Offer available until further notice.

Applications will be accepted at the Naples and Fort Myers locations as they are able to open and MidWestOne bankers are ready to work directly with anyone in need of assistance to identify options to alleviate hardship.

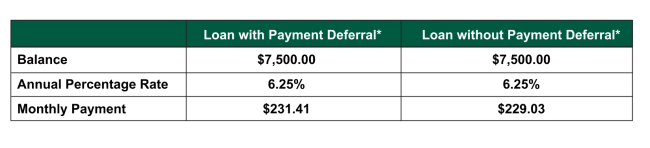

*Loan terms up to 36 months. Calculation based on a 36 month loan term with the lower available Annual Percentage Rate with automatic payments from a MidWestOne deposit account. The Annual Percentage Rate will increase by 1.00% without automatic payments. Borrowers have an option to choose a 90-day deferral of their first payment, however, interest will still accrue during this time. The payment deferral option will increase the monthly payment amount. Rates are subject to change.